What to think about when you think about exiting

Apr 30, 2021

I’m obsessed with helping entrepreneurs go from workaholic zombies to unlocking their freedom by transforming their businesses into valuable assets.

And the right route to freedom for a lot of entrepreneurs is an exit strategy. That’s why I’ve written so much about how to find out what your business is worth, the types of business exit, and how to structure an earn-out.

But business exits get seriously romanticized.

While walking off into the sunset with a big bag of cash certainly sounds nice, things aren’t always that simple when it comes to selling your business.

And no matter how successful your exit is, you might be short-changing yourself if you don’t think through how much you could make by righting the ship and sticking with it instead.

In this article, I’ll pull back the curtain on my exit and reveal the things you should be thinking about when you’re weighing up whether or not to exit your business.

Suffering is optional

In What I Think About When I Think About Running, author Haruki Murakami writes: “Pain is inevitable. Suffering is optional.”

Running a business hurts. That’s why us entrepreneurs talk about “grinding”, “hustling”, and pouring our blood, sweat, and tears into our business.

But while the hurt is inevitable, the suffering is something you can control. As the great Stoic philosopher, Epictetus says: “Man is troubled not by events, but by the meaning he gives to them.”

The problem us entrepreneurs run into time and time again is that we’re control freaks by nature, right to the bitter end. We crave control like Gollum claims “the precious” in Lord of the Rings.

Our knee-jerk reaction to pain is to try and control the situation, and we kick into micromanagement mode.

We cling onto control until our knuckles turn white and then wonder why…

- Other businesses in your sector are doing so well while you’re struggling to make monthly payroll.

- You’re working your ass off building a business with very little to show for it, while all around you grandiose exits go down and millions are made. You want a bit of that too!

- You can’t take some money off of the table for your kids’ college education or to buy your dream home.

- You can’t find time to spend with your family and working on your hobbies.

- You’re making less money now than when you started the business.

And it’s natural to start asking yourself whether it’s all worth it...

No man’s land

I was riding in the backseat of an SUV. Jack, my client, stared silently out the window while his wife was at the wheel.

It was one of the lowest moments of his life.

Later, he told me the thoughts that were racing through his mind on that journey:

“I’m sick of running this business. I wish I could sell it and go back to picking up other people's trash on the lake. I was making more money and life was a hell of a lot simpler.”

To Jack, “trash” meant wealthy people's unwanted toys – televisions, exercise bikes, jet skis, and the occasional boat. His first business was collecting these unwanted trinkets, polishing them up, and selling them on.

Fast forward a few years to that car ride and Jack owned a high-growth tech company – five years in and $4 million in revenue.

It had been a painful road. But Jack was that rare kind of entrepreneur fueled by grit and determination that managed to make it through the startup stage where most others fail.

Jack had bootstrapped his business, and it was viable with a positive cash flow.

But just when he thought everything was going his way, the business flatlined. Jack was in no man’s land, and he was suffering.

The entrepreneurial life cycle

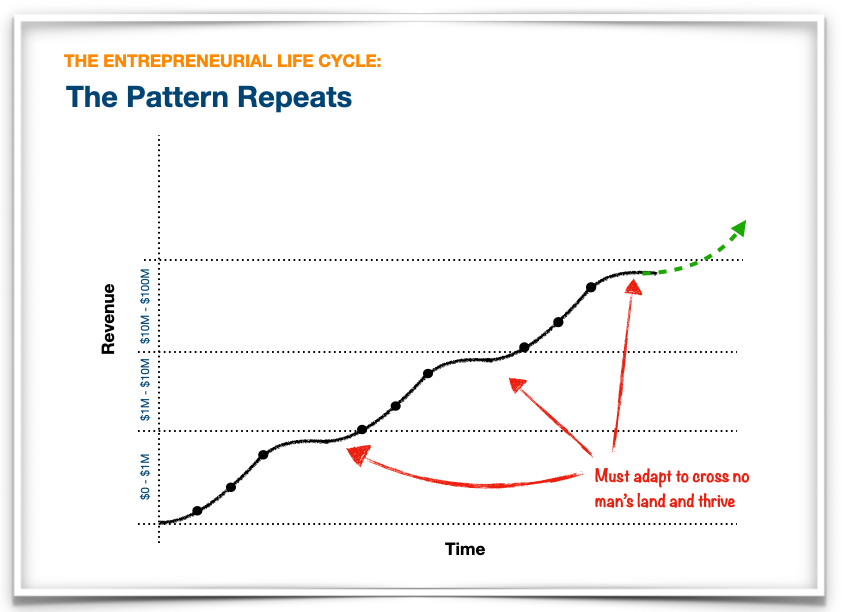

The entrepreneurial life cycle is made up of a series of ‘S’ curves.

You start a business because you think you’re onto something, and it goes something like this...

(Image adapted from Scalable: The Scalable Operating System)

You work your ass off for a while until you begin to believe your idea is hopeless and head back to your day job.

Or, like Jack, you make it through and think, “hang on, we might have something here!”. Then you experience phenomenal growth and think to yourself, “Hell yes! It’s working!”.

After some initial success, like Jack, you think, “Let's scale this thing – and get rich”...

Then things suddenly stall. And you wonder, “what the hell is going on, where’s all the growth?”.

And the suffering begins.

I call this no man’s land, and some business owners find themselves stuck here for years.

Once you find yourself in it, the only way out is to make a conscious decision to scale or retreat.

But what happens to a lot of entrepreneurs is that self-doubt starts to kick in. They get the idea that cutting their losses and selling their business is the right move.

And the longer you spend in no man’s land, the worse the suffering gets, the more tempting selling becomes, and the further you fall into “the death zone”.

(Image adapted from Scalable: The Scalable Operating System)

I talk a lot about exit strategies because I don’t want to see you languishing in no man’s land. I want you to have clarity on where you’re steering your business and consider the inevitable: that one day you are going to exit it.

But don’t get me wrong – that’s not because I’m lauding the idea of an exit. Hell, the gory details of exits are hardly ever known or the full cost – emotional as well as financial – ever considered.

What is important is that you consider all your options, set the right goals, then consciously build a valuable business that helps you achieve those goals.

So when you start thinking about throwing in the towel, it’s important to realize that selling your business isn’t the only – or necessarily the best – escape from no man’s land.

That’s certainly something I wish I’d taken into account before I pulled the trigger on my exit strategy.

What to think about when you think about exiting

“Our business had a host of problems, and we naively thought that selling would make them go away. In retrospect, the problem was us.” - Before the Exit

Unless you’re ready to retire, there’s usually some deeper suffering going on if you’re thinking about selling your business...

- You’re bored with running your business.

- You’re not willing to fix the foundations of your company by implementing The Core Four.

- You’re not interested in hiring and building a management team.

- You might be worried about the competition and technological innovations that are affecting your business.

- You might be having trouble agreeing with partners or investors on how to run the business.

To top it all off, the idea of exiting is an exciting challenge – something us entrepreneurs can rarely resist.

Not to mention that the prospect of a pile of cash can be irresistible.

But here’s what most entrepreneurs don’t think about because they don’t take the time to think about their vision for the business all the way through to succession.

What are the hidden upsides of your business?

When I decided to sell my business, I was simply sick of running it. I didn’t stop to think things through. All that was on my mind was the pile of cash I’d have to pile straight into the next thing.

I wasn’t thinking about the stream of cash I was walking away from. I wasn’t thinking about the potential of the platform I had already created.

I was suffering, and the simplest solution seemed to be to sell my business.

Like Jack, I had successfully navigated the start-up phase and had a bootstrapped business with a healthy cash flow. Over the years I had used that cash flow as platforms to acquire new businesses.

I acquired a competitor with no money down. I simply took over the debt in their business and arranged payment terms with our mutual supplier. I had the trust equity to pull off the deal and added a million in revenue to my business – and then quickly paid off the loan.

I also used my cash flow to fund the acquisition of a document storage business, and our strong brand to attract a partnership with a Swedish company that led to sole distribution rights of their product. This brought multiple millions into our group of businesses.

I’d built a powerful platform for scaling a group of companies.

However, I was also being pulled by my emotions. I wanted to start over with a clean slate.

Only I’d forgotten how hard starting over really is... even with a pile of cash.

My post-exit plan was to become an angel investor. To join the sexy startup scene and invest in a new, exciting project that would make me an even bigger pile of cash.

The startup world certainly is alluring. But the failure rate certainly is high.

I moved my family (and part of my team) to Denver and invested in a startup that had barely launched before it burst into flames – burning through my pile of cash in the process.

A better approach might have been to stay at the helm of my business and acquire an existing business in the US using my platform and cash flow. This was something I had done so many times in the past that by that point it was like playing a video game with cheat codes (which, of course, was part of the reason I was bored by my business).

Sure, I was suffering – but that suffering was optional. I could have gone to work on building a valuable business that I could have transformed into an acquisition machine, but I’d been languishing in no man’s land for so long I never sat down and considered all my options. I just wanted out.

Looking back, it was a textbook case of being ruled by my emotions. And in the words of the 17th-century Dutch philosopher Baruch Spinoza: "When a man is prey to his emotions, he is not his own master."

Rather than dealing with those emotions in a healthy and productive way, I boxed up in an ‘exit box’ and treated it as a new and exciting challenge – “doing the exit deal”.

Only this wasn’t just another deal. This was my last deal.

I went from having a platform and cash flow to having to start over with a pile of cash. And I very quickly burned through that pile of cash through tax, bad investments, poorly planned projects, and ego.

I should have thought about hiring a CEO

“What got you here won’t get you there” is a cliché in business because it’s so true.

So many entrepreneurs resist change at all costs, whether it’s the way they market their business or the people they employ, or the products they create.

Because we manage to get the business from $0 to $1 million, we think we’re capable of scaling from $1 to $10 million, then from $10 to $100 million. But you need a totally different skill set to navigate each of these stages, and very few people can master them all.

I find it helpful to picture each stage in your business’s life cycle as being represented by an ‘S’ curve:

(Image adapted from Scalable: The Scalable Operating System)

You need to adapt each time you reach no man’s land to thrive – and in the long run, just to survive.

The longer you spend languishing in growth purgatory, the more you’re going to suffer and the more tempting a premature exit will be.

I did plenty of things to increase the value of my business, but I should have taken things a step further and brought on a seasoned CEO to help me execute my vision.

Even if they were only a mediocre hire, that person could have alleviated a huge amount of suffering for me and freed me up to work on my business rather than in it.

My business had a host of problems, and I thought selling would make them go away. But I never considered that perhaps a more seasoned CEO might be the right move.

Before you put an exit in motion, I’d urge you to install your own CEO. Even if you do still decide that selling is the right step for you, taking this step will help drive up the value of your business and earn you a bigger payout.

Test drive an exit

Once you have a CEO in place in your business, you’ve reached a crossroads. You choose to put an exit strategy in motion or keep building a valuable business that can run without you.

What I wish I’d done myself – and I strongly recommend you do at this stage – is test drive an exit.

Walk away from your business for an extended period to get perspective and discover what life would really be like after you’ve left the building.

Most business owners never take the time to step away from their business to get some clarity on what the right next step is.

Stepping back from the day-to-day might be such a weight off your mind that it becomes clear that the right route for you is to exit.

Or you might quickly find your mind whirring about the “next big thing” – the next goal to chase.

And if this is the case, it’s crucial that you ask yourself: “Is that really a better opportunity than the one I already have right in front of me? Is throwing away what I have with my current business to chase that shiny new object really my best move here?”.

Putting some distance between you and your business will help you put your emotions to one side while you weigh up the options in front of you.

Then you can make an objective decision on what’s the best move for you given the position you’re in.

To help extract your emotions from the decision, even more, it can be helpful to imagine it’s a good friend that you want the best for in your position rather than yourself. What would you advise them to do?

This will help you find the right route for you – whether it’s staying on at the helm of your business or starting the search for a buyer.

The rise of acquisition entrepreneurship

One thing it’s important to be aware of before you pull the trigger on selling your business is the growing trend against venture capital and private equity and back towards bootstrapping businesses organically.

And that means there is a huge opportunity right now to scale your business by using it as a platform to acquire other companies.

If you’re thinking about starting over as I did, I’d urge you to think about the high failure rate associated with starting a new business. 50% don’t survive the first five years.

Acquiring an existing business lets you bypass the whole startup phase. You’d be buying customers, a team, a viable business model, and cash flow instead of sinking your pile of cash into the uncertainty of a startup.

Of course, you need to make sure your business has extremely strong foundations before you start hoovering up other companies, or else you’ll just be adding to your problems.

So, be sure to:

- Implement The Core Four – the four foundations of a valuable business.

- Build an effective leadership team.

- Remove yourself from your business’s daily operations.

- Switch to a recurring business model.

- Explore the nine changes that increased the value of my business the most.

The true path to freedom

I hope this article has shown you that selling your business isn’t always the most effective way to earn your freedom.

Depending on your situation, holding onto your business might give you even more freedom than an exit – and will get you there a lot faster.

But you need a plan. You need a vision of what you want from your business and clarity on what you’re going to do when you inevitably reach no man’s land.

If you take away one thing from this article, ask yourself: is it the best move for me right now to sell my business, or am I just languishing in no man’s land?

If you’re stuck in growth purgatory and you need some help figuring out how to escape, then book a conversation with me and I’ll be happy to help.

And be sure to check out my blog and subscribe to The Freedom Experience podcast for more insights into building a valuable business.